Mriya Report Cyber Tech Compliance AI for 15th August 2025 - VJ Day.

Chris Windley

M&A, Growth & Maximum Exit Value Strategies. Fitness,Tech, Cyber Security,Compliance,AML,KYC,UBO - supporting Fitness Millionaires link >

August 15, 2025

Headline

Recording of the Broadcast HERE.

Putin–Trump Alaska summit looms as Russia pushes tactical gains; Ukraine strikes deep and keeps the drone/AI edge. ReutersAP NewsThe Kyiv Independent

Protests in Anchorage in support of Ukraine.

Trump called VE Day " Victory Day in America " so what is VJ Day then ?

Battlefield snapshot (last 24–48h)

Russian pressure: Further small advances/infiltrations on the Donetsk axis (Pokrovsk/Dobropillia direction), aimed at stressing Ukrainian GLOCs rather than city assaults. AP NewsInstitute for the Study of War

Strike tempo: Another heavy overnight wave: ~97 drones + missiles; UAAF claims ~63 drones downed. Guided-bomb use remains intense. newsukraine.rbc.ua+1Українська правда

Ukrainian reach: Ukraine claims a strike on Olya port (Astrakhan), a logistics node alleged to support Iranian arms flows to Russia. The Kyiv Independent

Trendline (month-to-date): Russia adding territory incrementally; ISW maps and independent tallies show continued, modest net gains. Institute for the Study of WarRussia Matters

Air & long-range warfare

F-16s: Ukraine’s dispersed/“on the move” F-16 concept continues to mature (specialized ground support vehicles), consistent with ACE-style ops. The War Zone

Drone war: Kyiv targeting 4–4.5M drones in 2025; >1M FPVs reportedly delivered in H1. Russia adapting with repeater/sleeper/fiber-optic drones to hit rear logistics. ReutersDefence Industry EuropeInstitute for the Study of War

Interceptor innovation: “Sting” $2.5k Ukrainian interceptor drone hitting ~315 km/h, fielded in limited numbers to kill Shaheds. Business Insider

Diplomacy & politics

Alaska summit (today): Trump and Putin meet; Moscow seeks sanctions relief and territorial “concessions” framing; Kyiv rejects ceding land. Allies watch for linkage to arms control or a three-way process. ReutersAP NewsIndiatimes

US aid picture: Senate appropriators advanced a bill with Ukraine funds despite White House resistance; overall FY26 outcome still uncertain. Reuters

EU sanctions: The EU’s 18th package targets energy revenue/banking/tech leakage; enforcement focus rising. Finance

Cyber front (what matters this week)

CERT-UA warns of fresh malware/phishing waves (UAC-0099; HTA→PowerShell chains; WinRAR CVE-2023-38831 seen historically). APT28/LameHug reporting continues. The Hacker NewsIndustrial Cyber

Regional threat picture: European services flag Russian ops vs critical infrastructure (Poland daily volume; Norway dam incident). Logistics nodes tied to Ukraine support remain priority targets. The TimesThe Guardian

Allied advisory: Multinational alert on GRU targeting of Western logistics—watch NGOs, transport, and defense supply chains. CISA

What’s new in Compliance world

UK (FCA & OFSI)

Woodford case: FCA fines totalling ~£46m (Woodford personally £5.9m; WIM £40m) and a ban; both appealed to the Upper Tribunal. Useful case points on liquidity/risk governance. FCAReuters

In plain English:

He ran a daily-dealing fund full of hard-to-sell stuff. Investors could take money out any day, but the fund held lots of illiquid small/private companies, so cashing people out quickly was hard without big losses.

Liquidity was mismanaged. The fund over-concentrated in illiquid names and didn’t keep enough truly liquid assets to meet redemptions when sentiment turned.

Risk/governance didn’t bite. Controls and oversight failed to challenge the portfolio’s liquidity profile early enough or hard enough.

Communications didn’t match reality. What investors were told about risk/liquidity didn’t line up with how the fund was actually positioned.

Outcome: A run of withdrawals → fund suspension (2019) → investors trapped and losses crystallised → redress via the ACD (Link) and FCA fines/bans for Woodford/WIM.

not directly. Woodford is mainly a liquidity/governance failure in a daily-dealing fund. YouControl is KYC/AML/UBO intelligence.

But it’s still a great door-opener for YouControl because managers and ACDs now want to show their homework on counterparties and conflicts:

How YouControl fits (indirect but valuable):

Pre-investment DD on illiquid/private names: UBO, sanctions/PEP, adverse media, corporate history.

Always-on monitoring: Alerts for director/shareholder changes, insolvency flags, sanctions updates across portfolio holdings.

Connected-party mapping: Spot related parties/cross-holdings to reduce hidden concentration/conflict risk.

ACD oversight evidence: Exportable reports/audit trails to document challenge and ongoing checks.

What the FCA decided (Aug 5, 2025)

Penalties: £5.89m for Neil Woodford personally + £40m for Woodford Investment Management (WIM).

Bans: Woodford is prohibited from holding Senior Manager roles and from managing funds for retail investors.

Grounds: Failures in liquidity risk management and governance of the Woodford Equity Income Fund (WEIF), breaching FCA Principles (skill, care & diligence; customer interests). FCAReutersFT Adviser

Redress already in motion (separate to the fines)

Link Fund Solutions (the fund’s ACD) agreed a ~£230m redress scheme for trapped WEIF investors; the High Court approved it and the scheme became effective 5 Mar 2024. First payments were made around April 2024. (This is distinct from the FCA’s fines on Woodford/WIM.) FCATheyWorkForYou

Appeals / status

Both Woodford and WIM have said they will refer the FCA’s decision to the Upper Tribunal (i.e., they’re challenging it). Expect months before any final outcome. Sidley Austin

Scale & context

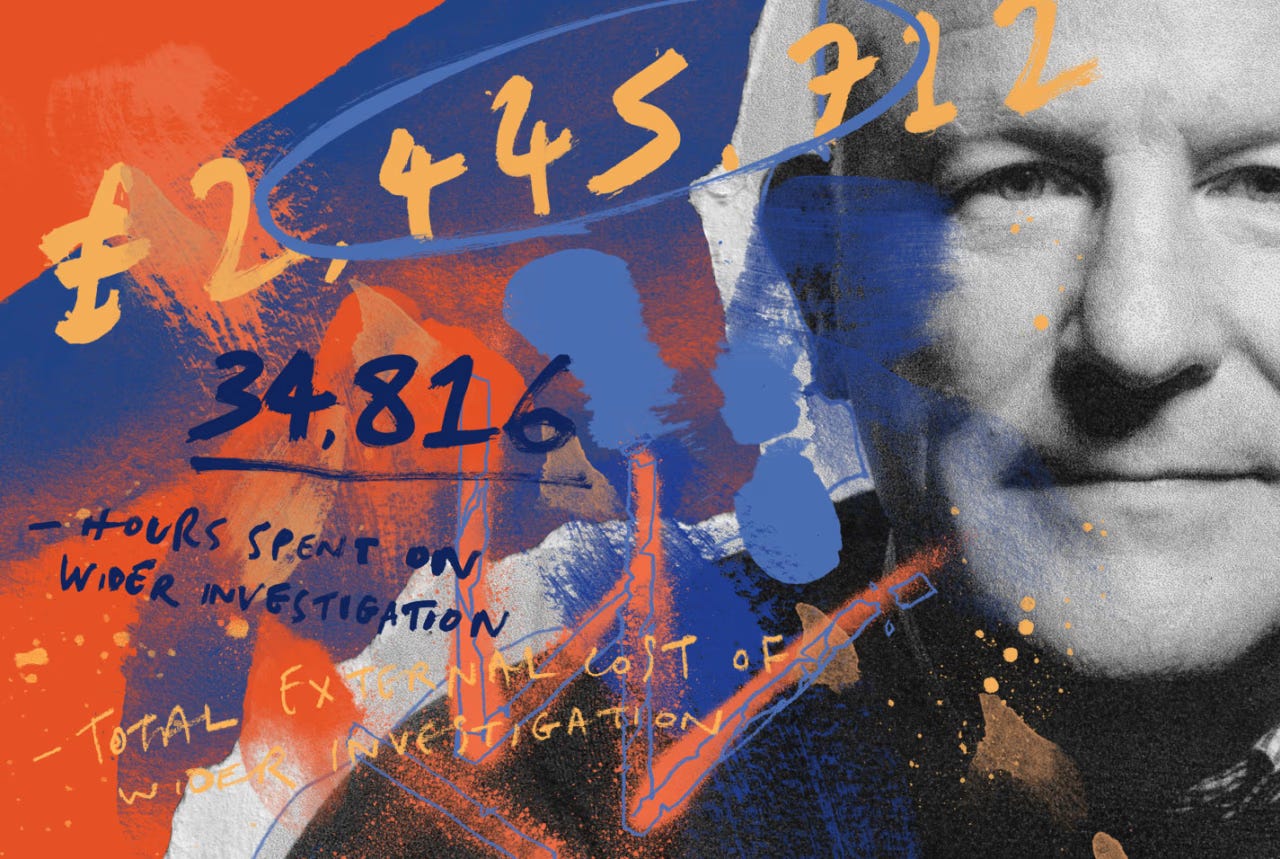

The FCA says its Woodford probe has cost ~£2.4m in external spend over 2019–2024; the fund peaked above £10bn AUM and was suspended in 2019, affecting ~300,000 investors. F N London

Compliance takeaways (what to check now)

Liquidity governance: Evidence Board/Senior Manager oversight of liquidity profiles vs dealing terms; show hard limits, early-warning triggers, escalation logs. (Woodford’s case centred on illiquid exposures in a daily-dealt fund.) FCA

ACD/host oversight: If you’re an ACD or use a host, document ongoing effective challenge—not just periodic sign-offs. The Link redress shows ACD liability can be material. FCA

Customer communications: Marketing and platform listings must reflect true liquidity risk; align KIIDs/KIDs, factsheets, and adviser materials with actual portfolio composition. FCA

Crisis playbook: Keep a tested suspension/side-pocket/communications plan; record scenario tests and who signs off what and when. FCA

Transaction reporting: Sigma Broking fined £1.09m for five years of inaccurate MiFIR reports. Good hook for brokers/venues. FCA

Financial crime controls: Monzo fined £21m for AFC failings (2018–2020) and breaching a high-risk account-opening restriction. Great talking point for fintech onboarding/monitoring. FCA

Sanctions enforcement: OFSI fine on a company linked in reporting to the Rotenberg network (~£300k) underscores UK appetite to penalise facilitation routes. Financial Times

OFSI guidance & lists: Core guidance and “who is subject” pages refreshed; general licences collection updated 7 Aug. GOV.UK+1

US (OFAC)

Crypto/sanctions-evasion: Treasury sanctioned a crypto exchange + network tied to cybercrime & evasion (14 Aug). Use this to push crypto/KYT + sanctions perimeter checks. U.S. Department of the Treasury

Recents include Russia GL issuance (13 Aug), DRC, Iran, and cartel/counter-terror designations (11–14 Aug). OFAC

FATF / EU

FATF: June outcomes—BVI & Bolivia added to the grey list; July report on evolving terrorist financing risks (useful for risk assessments). FinCEN.govFATF

EU: Recent council decision extended Iran-linked sanctions to 27 Jul 2026; some listings updated. Steptoe

How to use this (today)

Fintech & banks: Lead with Monzo + OFAC crypto actions → “tighten onboarding & ongoing monitoring; prove sanctions/KYT coverage (including VASPs).” FCAU.S. Department of the Treasury

Brokers/venues: Use Sigma → “close MiFIR gaps; reconcile reference data; prove end-to-end TR accuracy.” FCA

Law/accountancy/corporate services: OFSI enforcement + EU/Iran update → “stress test sanctions screening & beneficial ownership tracing (esp. Russia/Iran networks).” Financial TimesSteptoe

All sectors: If operating in/with BVI/Bolivia, escalate EDD; document TF controls in line with FATF’s July paper. FinCEN.govFATF

Another Excellent Newsletter for AML News.

If you want, I’ll turn this into 3 short Sales Navigator scripts (fintech, brokers, law) that reference these actions so you can message prospects immediately.

Fresh compliance headlines to cite

Britain fines Neil Woodford, his management firm over $61 million

Rotenberg family-linked company fined £300,000 by UK Treasury

FCA's Neil Woodford probe racks up more than £2m in costs

Info space & morale notes

High-volume strike nights in Kyiv/Kharkiv/Sumy are back in the headlines; UA framing emphasizes resilience and interception rates; RU framing ties gains to summit leverage. The Guardianeuronews

What to watch (next 72 hours)

Summit outputs: Any mention of “pause/ceasefire,” territorial status, or conditional sanctions relief—plus whether Kyiv is included in a follow-on format. Reuters

Donetsk sector: Does RU convert local penetrations into a push on Pokrovsk lines or cut supply roads with guided bombs/FPVs? AP NewsInstitute for the Study of War

Cross-border strikes: Follow-up on Olya port and other logistics nodes (Caspian/Volga nexus, Iranian route claims). The Kyiv Independent

Energy grid: If missile/drone volleys persist, expect targeted EW/cyber accompaniment—watch CERT-UA and regional DSO advisories. The Hacker News

On-air / socials (short lines you can use)

“Drones and diplomacy: Russia presses near Pokrovsk as Trump and Putin meet in Alaska; Ukraine hits back deep at a port tied to Iranian arms flows.” AP NewsThe Kyiv Independent

“UA air game: F-16s go mobile; FPV totals pass 1M in H1; new $2.5k interceptors hit 315 km/h to swat Shaheds.” The War ZoneDefence Industry EuropeBusiness Insider

“Cyber spillover: GRU eyes Western logistics; Poland reports ~300 attacks/day; CERT-UA flags fresh phishing/malware.” CISAThe TimesThe Hacker News

Further reading (today):

Today’s key Ukraine links

Trump will seek to squeeze Ukraine ceasefire deal out of Putin at Alaska summit

Ukrainian defenses face a challenge as Russian troops make gains ahead of the Putin-Trump summit

Ukraine war briefing: Putin says US making ‘sincere efforts’ to end war as Russian troops make gains

Institute for the Study of War

Yep—there’s a lot of noise. Here’s the clean read on what’s actually been confirmed in the last 72 hours:

Russian push near Dobropillia/Pokrovsk: DeepState’s map and multiple wires show a narrow Russian wedge north of Dobropillia threatening roads toward Pokrovsk; Ukraine says it’s stabilised after rushing reserves. So: real gains, but not a breakout. Reuters+2Reuters+2

No big movement elsewhere: ISW’s latest notes Russian attacks around Chasiv Yar/Toretsk but no confirmed advances there. Institute for the Study of War

Ukrainian gains (small, local): Kyiv claims retaking a couple of villages in Sumy; Reuters flags it as not independently verified yet. Treat as provisional. Reuters

Ukrainian deep strike (confirmed by UA sources): A Special Ops strike hit Olya port (Astrakhan), reportedly a hub for Shahed components from Iran; effects still being assessed. Multiple Ukrainian/independent outlets reported it. The Kyiv IndependentUkrinformEuromaidan Press

Quick way to sanity-check daily claims

ISW daily map for control-of-terrain changes (they only log geolocated/confirmed shifts). Institute for the Study of WarInstitute for the Study of War

DeepStateMap for rapid frontline edits (fast, but sometimes ahead of full confirmation). DeepStateMap

If you want, I can keep a tiny tracker that flags only geolocated/confirmed changes and ignores “claims.” For now, these are the best reads for tonight.

Frontline: what changed & what didn’t (past 72h)

Ukraine says eastern front stabilised after recent Russian thrust

Ukraine makes small territorial gains in Sumy ahead of Trump-Putin summit

Ukrainians confront prospect of losing Donbas in Trump-Putin talks

Trump–Putin Alaska summit — quick predictions (today, Aug 15)

Baseline: expectations are low for a grand bargain; watch for narrow, transactional steps and a PR-heavy joint line. The Washington PostThe GuardianAl Jazeera

U.S. President Donald Trump's meeting with Russian President Vladimir Putin will take place at 11 a.m. (1900 GMT) in Anchorage, Alaska, ...

Most likely outcomes (high confidence):

Process, not peace: A joint statement to “continue talks,” with working groups (POWs, humanitarian corridors, nuclear safety at Zaporizhzhia, grain/shipping). No territorial settlement. The Guardian

Optics win for both: Putin gains stature by meeting on U.S. soil; Trump claims momentum toward ending the war. Substance thin. The Washington PostTIME

Possible limited deliverables (medium confidence):

Prisoner swap / humanitarian package and language on nuclear plant safety and grain routes. The Guardian

Ceasefire exploration: Agreement to explore a ceasefire or local pauses; no map lines fixed today. Al JazeeraABC News

Low-probability big moves (watch, but unlikely today):

Freeze along current lines with de-facto recognition of Russian control—faces huge obstacles (Kyiv not at the table, EU stance, U.S. Congress). The GuardianThe Washington Post

Sanctions relief trade-off: Immediate broad relief is unlikely; at most, talk of conditional steps tied to verifiable de-escalation. The Washington Post

Red flags / what to listen for in the presser:

Mentions of “temporary ceasefire,” “demilitarized zones,” or “referendums.” These signal a push to freeze the front on Russia’s terms. The Guardian

Any talk of Ukraine joining later versus being part of talks now (legitimacy gap). The Washington Post

Hints of resource/economic side-deals (energy, Arctic, tariffs)—controversial if tied to Ukraine concessions. The Washington PostTIME

Why Alaska matters (the optics): Symbolism, proximity to Russia, and security control for a leader under ICC warrant; it’s a stage for optics more than breakthroughs.

Putin is the anti-Christ